- Unsportsmanlike Boardroom

- Posts

- 🥁 Welcome Back, March Madness

🥁 Welcome Back, March Madness

Reading between the lines of the bracket business

AP Photo/Susan Walsh

Well friends, it’s finally here. Sure, we’re already 19 days into March, but the madness is just around the corner. Get ready to redownload those Tournament Challenge apps, pretend like you know what you’re talking about after watching maybe 1 conference championship game, and make sure you’re either WFH or know how to minimize a window as quickly as possible when watching games. But before we get mesmerized by Bill Raftery’s calls, let’s go through the business of March Madness. From understanding the media rights, to ad and marketing deals, to the economics for host cities, etc. — we got you covered for a better understanding on how the NCAA runs its cash cow. Let’s get after it…

Why is March Madness taking over my TV?

What a great question, little Susie! In 2010, CBS Sports and Turner Broadcasting (now under Warner Bros. Discovery) signed a $10.8B deal with the NCAA to broadcast the men's basketball tournament ending in 2024.

In 2016, they enjoyed the fruits of their labor and agreed to an 8-year extension lasting through 2032, valued at $8.8B.

It’s why you’ll be bombarded with college basketball content from both the men’s (CBS, TNT, TBS, truTV) and women’s side (ABC, ESPN, ESPN2) all month long!

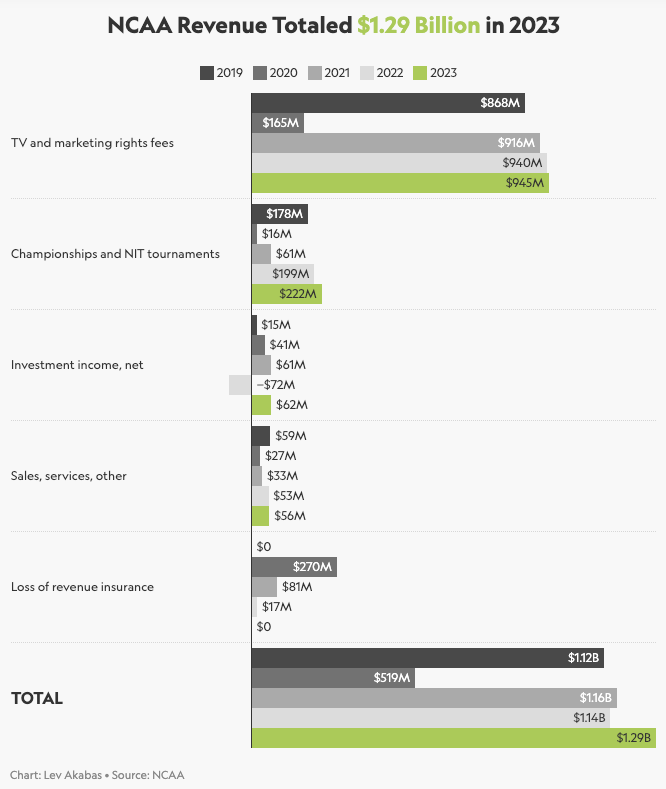

What’s interesting is that the NCAA men’s basketball tournament made up more than 80% of the organization’s $1.3B FY2023 revenue (see Table 1) 💰. Look for that percentage to decrease in 2024 once the women’s new media rights deal starts in September.

Even though college football is a bigger commercial property than basketball, the NCAA neither controls nor profits off the College Football Playoff (CFP).

That’s right…nearly 40 years ago (in a Supreme Court case of NCAA v. Board of Regents), the NCAA lost its controlling stake of football as schools wanted more leeway to broadcast their games on Saturdays across major television networks.

Since then, the NCAA recognizes the decisions made by the independent conferences. It’s why for the new CFP media rights deal with ESPN, revenue distribution will be between the conferences, not the NCAA.

Table 1

We get it, the tournament is popular, but why are networks paying an arm and a leg for this?

It might be hard to believe, but outside of the Super Bowl, March Madness is the highest ad revenue-generating post-season in American sports.

To give you an idea, in 2023 according to SportsPro:

Advertisers paid ~$2.3M for spots in the national championship game.

CBS received $694.7M in national TV ad revenue from the tournament.

TBS received $184.8M, TNT received $82.7M, and TruTV received $59.8M.

Yep, you did the math right...that’s more than $1B of ad revenue for the tournament! 🤯

Even though the viewership of the men’s national title game has seen a little dip (more likely to do with the teams playing in the game). There is still consistent staying power with men’s college basketball.

The men’s national title game has averaged 19.8M viewers since 2013. And saw more than 21M viewers tune in each year between 2013 and 2015.

For context, CFP title games have averaged around 24.8M viewers since 2015.

As for the women, they’ve been breaking records. Last year’s final averaged ~10M viewers (shout out, again, to the Caitlin Clark Effect).

Wow what a business, does the NCAA get to keep all this money?

If only it were that simple. Unfortunately for the NCAA, they’re a nonprofit organization, which means they can’t keep those stacks. So whatever money comes in, needs to go out.

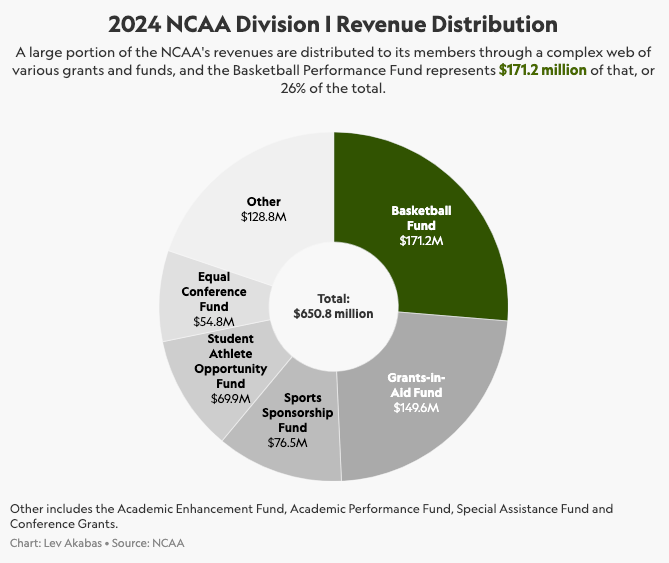

One way to help with the distribution of these funds came in 1990 when the NCAA created the “basketball performance fund,” a plan intended to more fairly divvy up tournament revenue and parcel it out among the country’s schools (see Table 2).

How does it work? Teams earn a “unit” for every tournament game they play up to the championship game.

For example, a team that makes it to the Final Four will earn five units. Each unit is worth a specific amount each year (usually ~$2M per team). And it’s up to the conferences to parse out the money to each team.

According to The Athletic, last year, the SEC topped all other conferences with roughly $34M from 17 units earned by its eight teams in the tournament 🏅.

Big 12 teams were next, playing in 16 games and earning an estimated $32M.

As for the women’s tournament, schools do not currently receive any revenue distribution units. But the NCAA said that could change as early as next year because of the new media rights deal (about time, huh?).

Table 2

Where else is the money flowing to?

Host cities. It’s not just the NCAA, networks, conferences, teams, staff, players, etc. that reap the benefits of being in the tournament. It’s also the 14 host cities that have the pleasure to put on a show in different regions throughout the country. Restaurants, hotels, entertainment venues, car rental companies, ride-share drivers, and the entire tourism economy benefit from both indirect and direct spending related to the games.

In 2023, the Final Four in Houston, TX resulted in estimated economic impact of $300M+.

In 2022, the Final Four in New Orleans, LA saw an economic injection of over $170M.

Dayton, OH has been the host for the “First Four”, and have earned ~$66M in additional revenue from 2001 to 2016.

Busted brackets and half-court parlays. More people than ever are expected to wager legally on both the men’s and women’s NCAA tournament, The Associated Press reports. That's because legal sports gambling has spread across the U.S. within the last 6 years. It’s currently allowed in 38 states + District of Columbia.

The American Gaming Association expects $2.7B in bets this year — a massive jump from the ~$300M bet legally in 2018, shortly before a Supreme Court ruling opened the door to legalized sports gambling.

NIL tournament. Because NIL is so prevalent in today’s world, it’s no wonder they want to get in on the action. There are currently reports of a new In-Season Men’s College Basketball Tournament offering up to $2M in NIL Deals.

It’s set to be held in Las Vegas as an eight-team event —expanding to 16 teams in 2025. And will pay out $1M to each team, and another $1M to the winner (all from sponsors and other tournament partners).

As of now, the teams in discussion to join the tournament are: Alabama, Duke, FAU, Houston, Kansas, Oregon, San Diego State, St. John’s, Syracuse, and Virginia.

Enjoying this really awesome newsletter? Share with your friends!

Quick Hitters

📖 Don’t say goodbye to Sports Illustrated (SI) just yet! Sure, we had some reservations a few weeks ago, but they’re back and ready to be read! Authentic Brands Group, the IP owner to SI, struck a deal with Minute Media on Monday to take the magazine and website publishing rights previously held by The Arena Group. The initial deal is for 10 years with the option to extend it with two more 10-year deals, according to sources. Authentic will also take a stake in Minute Media as part of the deal. Minute Media owns digital brands such as The Players’ Tribune, FanSided, and 90min. They generate more than $400M in annual revenue and plan to both continue SI’s print edition and expand its publishing operations globally.

🤑 Sports gambling is coming to NBA’s League Pass (FYI: NBA League Pass is a subscription service used to watch all NBA games live, even when out of network). The NBA and Sportradar, a global data company, are rolling out a new option for League Pass viewers to track betting odds on NBA games as they watch and offer the ability to wager through the NBA’s betting partners. As of now, the options will be limited to point spreads, money lines, and over/unders. Viewers will then be able to pick their bet and be taken to sportsbooks from FanDuel or DraftKings.

👑 LeBron James clearly felt left out of the podcast game. Because today, LeBron will team up with JJ Redick for the launch of their new podcast called, Mind the Game. It will be produced by LeBron’s Uninterrupted and JJ’s ThreeFourTwo Productions. The show will stay more focused on basketball than off-court topics with the co-hosts dissecting the X’s and O’s of the game. As of now, the podcast will launch with no media or advertising partners, as LeBron and JJ want the show and its format to be 100% their own.

🐟 My goodness, cash is being poured into the National Women's Soccer League (NWSL). A group led by private equity staple Carlyle Group and the MLS’ Seattle Sounders have reached an agreement to purchase the NWSL’s Seattle Reign FC in a deal that values the NWSL club at $58M. Like we said, cash has been injecting into the NWSL’s veins and it’s been driven by the number of recent sales:

In August, a group led by Chicago Cubs co-owner Laura Ricketts bought the Chicago Red Stars for $35.5M.

In January, the Portland Thorns sold for $63M.

Billionaire Ron Burkle agreed to sell the San Diego Wave in a two-part, $113M deal.

And rumor has it, the board of Angel City FC, the league’s most valuable team, has hired a bank to explore selling a control stake in the franchise.

Reply